The years when Japan’s economy almost conquered the world

Check out Tony Smyth’s website and other work ; FukushimaTokyoQuake.com

Tokyo of the 1980s was far more inward and conservative than its 21st-century cousin. The LDP had been in power continuously since the 1950s. Emperor Hirohito was still on the throne, safely transmuted from pre-war God into the mild mannered marine biologist who occasionally turned up at the Kukugikan to watch sumo wresting.

Before the Shiodome and Daiba development, upper Tokyo Bay consisted of drab concrete warehouses. The only tall buildings were one each in Ikebukuro and Kasumigaseki and perhaps fifteen in Shinjuku. Ebisu was still quiet and suburban. Shibuya had only just begun to creep towards Daikanyama and Harajuku.

Business dress was very rigid – dark suits, short undyed hair, 70/30 hair parting, white or off-white shirts, black shoes. Workers did even more overtime than is now the case, and businessmen in their hundreds died of karoshi (overwork). Lifetime employment was the norm in large companies, and changing jobs during one’s lifetime was considered shameful. A job for life meant your job was your life. Fathers only saw children at weekends.

As there were fewer subway lines, trains were crowded up to 400% in rush-hour, with only overhead electric fans for air conditioning. Train windows were left open in summer, which meant subways were incredibly noisy as they screeched around bends. ( and you thought it was bad now. HAH!) Only the train signs of the Yamanote Line were written in English. You could get lost for hours in the underground labyrinths of Ikebukuro and Shinjuku. Pre-Lonely Planet, there were no guide books exclusively about Japan. None. I came to Japan armed with a book on Asia, which had just 15 pages devoted to Japan. Consequently, Tokyo of that time was a much harder city for an outsider to negotiate.

In the early 80s, foreigners were still a relative rarity in the city, so much so that some discos would allow gaijin to enter gratis, in the hope that their presence would show that the club was hip. “Irrashai – live gaijins on display” (OK they didn’t say that, but that more or less was the idea). If you went into the countryside, people dropped their shopping and stared slack jawed at the phenomenon. Japan measured itself against one country – America. In fact, if you were a white foreigner in Japan at that time you were automatically assumed to be American. “Yoa cun-to-rii – Ame-li-ka?? Numbaa wan, numbaa wan” etc

Foreign goods were taxed so highly that most foreigners would stock up on clothes and books during their annual home vacations. Coffee was served in delicate china cups and cost ¥400-500 for two or three sips. In those pre-internet days, gaijin were far more isolated from the outside world than is now the case. As the Cold War was at its height, a flight to Europe necessitated either flying over the North Pole via Alaska, or doing the 24-30 hour Southeast Asian route, before finally arriving exhausted and dishevelled in London. A phone call to parents or friends was kept short as it was so expensive.

There were no fat Japanese people to be seen because they DIDN’T EXIST. The first McDonalds opened in Ginza during the Bubble – the prediction was that it would never become popular in Japan. HAH! Now read on…….

1986 – 1991

The new prosperity was unprecedented: to a people used to deprivation, poverty and sacrifice, it seemed miraculous. From 1959, the economy expanded by an average rate of 9.2% annually for fifteen years, and in the following fifteen years by an average 4.2%. By the 1980s, Japan was clocking up enormous trade surpluses globally, yet managed to protect its own markets from outside competition by a combination of a fiendishly complicated multi-layered distribution system, high import tariffs, interlocking keiretsu business relations and mutual stock holdings which tied companies together and excluded outsiders, together with bid-rigging and other collusive practices. Other features of this mercantilist system were a high rate of savings among the general population, easy credit available to industry at very low interest rates, cosy relationships between politicians, bureaucrats and businessmen, and, not least, the payment of large, sometimes obscenely large, bribes to politicians for favours. The Japanese used more robots for manufacturing than any other industrialised nation, had adopted the Quality Control (Q.C.) system and perfected the ‘just in time’ method of delivering parts for assembly. Japanese employees also worked significantly longer hours per week than their Western counterparts.

Japan as number one

By the 1980s, the country had become an economic superpower. Eight of the ten largest banks in the world were Japanese. The Tōkyō Stock Exchange was roughly the same size as the NYSE. In 1987, Japan accounted for one third of the $150 billion U.S. trade deficit. As General Motors, Ford and Chrysler laid off thousands of workers and closed ageing plants, container ships disgorged shiny new Honda, Nissan and Toyotas onto docks along America’s West Coast. The Japanese domestic economy was 80% the size of that in the United States, despite half the population base, about one-fortieth the land size, and virtually no natural resources. By 1990, every single week, a billion dollars flowed from the United States to Japan. Ezra Vogel’s bestseller ‘Japan as Number One’ was published around this time. Foreigners studied books purporting to show the samurai way of doing business, to the amusement of many in Japan. A poll of 129 by Tōyō Keizai, an economics magazine, predicted that Japan would outstrip the United States in output of goods and services by the year 2010. When President Bush Sr. visited Japan, he appeared to be pleading for mercy for the ailing American car industry. Prime Minister Miyazawa responded by saying that Japan would show “compassion”. As Bush vomited and collapsed at a Tōkyō state banquet, video cameras showed the diminutive Miyazawa trying to push the U.S. president upright. It seemed an apt metaphor for the two countries’ relationship during this period.

Year by year, Japan’s trade surplus with the rest of the world continued to increase by phenomenal amounts. With the exception of Middle East oil producers, every trading partner incurred a large trade deficit. By 1990, Ōsaka City and the Kansai had an economy that ranked seventh in the world. By the following year, Tōkyō officials were boasting that their city’s GDP was also closing in on that of the U.K.

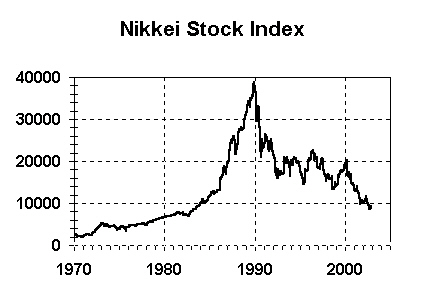

Mitsui & Co., a Japanese trading company with total revenues of $81.8 billion in 1986, displaced Royal Dutch Shell group as the biggest non-American corporation in the world. In 1989, the Nikkei Stock Index measured nearly 39,000 points. Tōkyō was headquarters to 94 of the 500 biggest non-American companies. Japan had more billionaires than the United States, though much of their wealth was based on the artificially high price of land. From the middle of the 1980’s, Japan had become the largest creditor nation in the world.

The Tsutsumi brothers

The world’s richest individual at this time was Yoshiaki Tsutsumi, one of two multi-billionaire brothers. By the late bubble period, the gruff and fiery Toshiaki owned 25 golf courses, 50 Prince Hotels – one of the world’s biggest hotel chains – and ski villages, leisure complexes, a professional baseball team and the Seibu Railway network, Japan’s largest landowner. At that time, his business empire was estimated to be worth $400 billion U.S. The elder, more cultured brother Seiji, poet and patron of the arts, owned the Saison Group, one of Japan’s most dynamic conglomerates, the 100-strong Intercontinental Hotel chain, museums of art, boutiques, avant-garde theatres, and a nationwide chain of chic and glamorous Seibu department stores. The brothers represented the pinnacle of a largely invisible pre-eminent elite, have strong imperial connections, and wealth so vast that they were estimated to own one sixth of the landmass of Japan.

Peak of the Bubble

The average Japanese had the highest income in the industrialised world by the end of 1987 – $23,022 a year. By 1990, senior managers were earning the equivalent of around U.S $60,000, plus twice yearly bonuses of between one and a half and three months additional salary.

At the height of the bubble economy, a million gallons of Beaujolais Nouveau would be flown to Narita Airport and quickly rushed to restaurants throughout Tōkyō so that, because of the nine hour time difference between Europe and Japan, it could be consumed before even the French had tasted the new wine. People happily paid $40 a bottle for this dubious privilege. After the decades-long infatuation with all things American, the bubble period saw a new inquisitiveness with respect to European fashion, food, art, music and culture in general. The bank accounts of Armani, Sonia Rykiel and Chanel swelled as Japanese snapped up their ware. Brown plastic Louis Vuitton handbags were almost de rigueur accessories for many years. It would be no exaggeration to say that, during the 1980s, almost every Japanese young woman carried one of these bags.

French restaurants could charge small fortunes for meals, simply because Gallic food was considered the epitome of sophisticated cuisine in trend-chasing Tōkyō. If you could persuade Japanese people that something was exclusive, sophisticated and fashionable, they were likely to pay exorbitant amounts for the privilege of sampling it. The best seats for concerts conducted by Herbert Von Karajan, for example, cost $574 each. When Miles Davis played at the opening of the Blue Note jazz club, punters paid $328 apiece.

Consumer confidence had never been higher, and this was reflected in changing tastes for expensive items, including imported cars. Tōkyō’s notoriously overpriced department stores made brisk sales throughout the 1980’s, in spite of the several hundred percent mark-up they charged. By 1991, Tōkyō had become by far the most expensive city in the world. 24 carat gold-flake filled soap became popular with women in their 40’s, though ten times more expensive than ordinary soap. Sales of male toiletries grew 30% annually. Pricey customised products sold well too: best-sellers included custom-made golf clubs, and personalised perfumes or wine, which had a minimum order of 200 bottles. Women’s tights, containing tiny capsules that emitted lavender, rose and other scents when heated by body warmth, sold in the millions.

Japan became the world’s leading purchaser of diamonds during this period, and indeed it still is. The chief of the jewellery section of the swank Mitsukoshi Department store said, “Several years ago you could buy a house for 50 to 60 million yen ($400,000 to $600,000). Now it costs up to 500 million yen. It tends to dull people’s sense of money. Nowadays customers come in asking to see diamonds of about 100 million yen”.

The bag man

One day during the bubble period, while travelling on the Yamanote Line, a middle aged man carrying a brown paper bag sat down beside me. He took out large wads of 10,000 yen notes from the bag and began to count them so, out of curiosity, I began to silently count along with him. By the time I had to get off the train, he had reached 900,000 yen and was still counting. The man was carrying at least $8,000 in cash, and thought nothing of counting it in full view of other passengers!

Prices in Ginza’s famed hostess clubs reached outrageous levels. One ex-patron of such clubs told me that he was once charged $246 for the ice for his whiskey. The charge for alcohol and the privilege of having a series of pretty young hostesses flirt and flatter for a few hours often ran into the hundreds of thousands of yen, usually paid on a very liberal company expense account. Prices at exclusive restaurants such as Kitchō, where prime ministers entertain their guests, or Fukudaya, where customers can dine in a wooden building 800 years old, were $578 per person for the basic course. They probably still are.

Costs compared to other countries

A survey conducted in 1988 revealed that rent in Tōkyō was double the levels in New York and Hamburg of that period. Another survey estimated that purchasing power of most Japanese remained at two thirds of their German and United States’ counterparts, and that quality of life was only 55% of Americans’. Infrastructure still suffered from decades of comparative neglect. In 1990, less than half of Japan’s households were connected to mains sewers (this mostly in the countryside). The family budget had to cope with light, heating, water expenses and postal charges twice as high as those in New York. Because of a multi-layered distribution system, even products manufactured in Japan cost more at home than abroad. Rice cost up to four times more, thanks in large part to a ban on imports and to generous subsidies that the LDP paid to farmers. California oranges costing 40 cents per pound in the U.S. could be priced at $4 dollars in a Japanese supermarket. And then there were the infamous muskmelons costing $40 to $50 each in high-class department stores.

Art

Beginning around 1987, the international art market saw the sudden arrival of Japanese collectors and investors, a new breed of multimillionaires who had made huge profits from land and stock transactions. Many treated artworks as assets to be used as collateral for business deals, or else resold at a quick profit. Others bought art for the status it gave. The owner of a gallery in Tōkyō explained, “If you owned a big chunk of Tōkyō’s high class Akasaka district, you were a nobody, but if you bought an expensive painting at auction, you could become one of the most famous people in Japan”. Yasuda, a Japanese insurance company, spent $40 million for the Van Gogh painting “Sunflowers”, more than triple the previous record paid at an auction. By 1989, Japanese art purchases accounted for 43% of global sales, setting new auction records for paintings by Chagall, Van Gogh, de Kooning, Matisse, Klee, and Renoir. Tens of thousands of artworks were acquired over a three-year period.

In 1990, a Japanese businessman, the late Ryōei Sato, stunned the art world by paying more than $160 million for a Van Gogh and a Renoir. When asked about criticism that his profligacy would push up prices for other masterpieces, he said, “It depends on the time frame you are talking about, when cheap and expensive are discussed. I don’t think these prices are expensive”. When asked what he would do with a Rodin sculpture that he bought in the same week, he said, “It was only 650 million yen. That’s for my yard”.

Hawaii

In 1987, more than a million Japanese businessmen and tourists visited the islands of Hawaii. It became the “in” thing to purchase a second house on the islands. Japanese bought golf courses, farms, hotels, and seemed to have a bid on every major office building in Honolulu. A leading realtor estimated that purchases of residences in 1987 had exceeded $250 million and, “are now reaching price levels which are beyond the means of even the wealthiest local residents”. The TV program ‘Newsstation’ broadcast an interview with a Hawaiian woman who complained on camera, “this Japanese man just came up to me and said ‘I want to buy your house’. He offered one million dollars”. The woman refused and told him to go away. The following day, he returned and offered to pay two million dollars cash if she would move out within a short period. Indignantly she demanded, “Just who do these people think they are anyway?”

At the height of the bubble, a program titled Deta Mono Shobu was aired once a month. The object of this program was to search North American and European countries for properties that might be of interest to rich Japanese. In a typical program, a helicopter carrying a Japanese TV crew landed at a 15th century French castle. After greeting the owners, the cameras transmitted images from the chateau live, via satellite, to Japan. The owner was asked how much he wanted for the property, and to write the figure on a card which he sheepishly displayed to the camera. In this case a mere $U.S 1.9 million, which prompted cries of yasui from the excited studio audience. Soon, potential buyers for the chateau phoned in to make inquiries. Amazingly, the program was produced with the co-operation of the Japanese government, which was attempting to show that it was making efforts to reduce Japan’s prodigious trade surpluses. During yet another broadcast, viewers were astonished to learn that a 175 acre chateau in France cost only three times more than the average central Tōkyō apartment. Yasui.

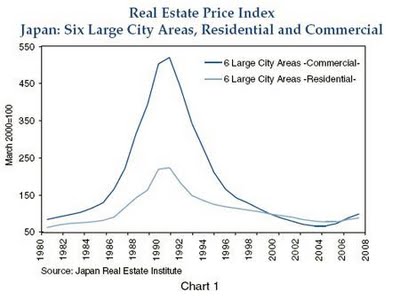

The ocean of liquidity

After the 1985 Plaza Accord currency realignment, the Bank of Japan reduced the discount rate to an all time low, resulting in an abundance of capital, often referred to as the “ocean of liquidity”. Stock prices soared. Heavy industries began to be valued on the basis of the vast tracts of realty they possessed. Landowners were able to borrow astronomical sums of money by mortgaging, and could then build factories overseas, or go shopping for ‘cheap’ foreign properties. The value of land in urban Tōkyō had increased throughout the 1960’s and 70’s, rising steeply in the mid and late 1980’s. There was a 75% average increase in the price of land during 1987 alone – in certain areas it rose by 100%. The land of the Imperial Palace was valued at more than all of the real estate in California. By 1990, a single square metre of land in Sanbanchō, a small residential area of central Tōkyō, cost up to $98,400, by far the most expensive residential land in the world. The madness had almost reached its peak.

Part 2 will be coming soon.

This is one of my favourite eras in Japan’s history. Very interesting times.

An entire country which went Roman.

That is a really good tip particularly to those

new to the blogosphere. Simple but very precise info… Thanks for

sharing this one. A must read post!

Thanks dudes. Actually my site doesnt have capital letters in it: its fukushimatokyoquake.com. the Ebook should be out hopefully at the end of Sept and in print by the end of the year.

The link still works though I think.

Amazing things here. I am very happy to peer your article.

Thanks so much and I am looking ahead to contact you.

Will you please drop me a e-mail?

Just found this now!!! You can get me via my websites fukushimatokyoquake.com or tokyotales365.com